Most people have never read Adam Smith’s book, The Wealth of Nations; and far fewer have read the complete, unabridged version, which exceeds 1,100 pages. This is understandable considering the 100s of pages that Smith devotes to mundane topics like exchange rates, corn production, purchasing power parity, labor wage rates, the virtues of the division of labor, and folksy business management advice. However, without an accurate understanding of Smith’s perspective on capitalism, corporate behavior, government intervention, taxation, and social welfare, it’s impossible to verify whether economic and trade policies today are consistent with Smith’s widely respected, nonpartisan theories on capitalism and free-market economics. Thus, it’s useful to confirm Adam Smith’s (and by extension, all Smithian’s) emphasis on human welfare in his own words.

The Definition of a “Smithian Economist”. As Enlightenment Age humanists, economists following in the tradition of Adam Smith have historically taken a holistic approach to economic analysis. In other words, they integrate all knowable domestic and foreign factors into their analysis and they base their observations and conclusions on real-world phenomena and corresponding real-world data, not fictionalized, abstract models. Because the term “holistic” relates to the philosophical and methodological characteristics of an economist’s analytical approach, there can be some occasional overlap between “classical” and so-called “neoclassical” liberal economists who may use model-driven analysis in some contexts, but not in others. To keep our classification process as concrete and simple as possible, and to avoid confusion later, let’s state the following:

When an economist integrates all reasonably knowable and relevant domestic and foreign factors into their analysis and they base their observations, conclusions, and economic policy prescriptions primarily on real-world phenomena and corresponding real-world data, they are “Smithian Economists.” In contrast, when they base their observations, conclusions, and economic policy prescriptions primarily on fictionalized, abstract mathematical models that artificially ignore important real-world factors, they are “Neoliberal Economists.”

The Qualified Virtue of Maximum Production. Both Smithian and Neoliberal economists believe human welfare can be improved by encouraging corporations and nations to maximize their production and profit. However, in contrast to neoliberals, the influence of Enlightenment Age humanism on Smithian economists typically results in them giving much higher priority to measures of sub-national human welfare in their economic theories and models, including the distributional consequences of economic policies on sub-national human populations.

Adam Smith on the Behavior of Capitalists & Corporations. On the nature of capitalists and their tendency to form cartels to monopolize markets (Smith’s “masters” here are known as “shareholders” and “owners of capital” today.):

Smith on the nature of corporate conspiracies against the public:

Smith on the tendency of corporations and capitalists to manipulate government policies to enrich themselves at the expense of the general public:

Adam Smith on Taxes to Support General Human Welfare. Many Libertarians and neoliberals invoke Smith’s name to claim that governments have no right to collect taxes to fund social welfare programs. In making this claim, they ignore Smith’s many explicit statements on taxation to fund the collective welfare of a nation, and not just for homeland defense. Smith understood that social welfare programs are just as important as roads, infrastructure, and defense because broad-based prosperity and social stability are not achieved through market mechanisms alone. Smith understood that peaceful societies cannot exist without substantial government expenditures to create social stability.

Smith on the need for corporations to pay taxes to preserve the health, welfare, and integrity of their home societies:

Smith on the principle of progressive taxation on “rents” (not income) to assist the poor:

Smith on how a “whole society” should pay taxes to support public education:

Smith on taxes to support the administration of justice:

Smith on the importance of taxing the people who are closest to where tax revenue will be used:

Smith on taxes and public tolls to pay for roads and other infrastructure projects:[9]

Smith on taxes to pay for public programs and projects that are “beneficial to the whole society”:

Smith on Tariffs. Smith is famous for his “invisible hand” concept, which many neoliberals and libertarians incorrectly assume means that government should never regulate or tax any market activities whatsoever. In reality, Smith was not opposed to tariffs, anti-trust enforcement to prevent market failures, taxes, and government regulations that could be reasonably expected to improve the welfare of a country’s citizens and prevent humanitarian crises. For example, Smith on tariffs:

Our Economic Godfathers Had a Home Bias. I suspect this will surprise many people who have never actually read the complete works of Adam Smith, David Ricardo, John Stuart Mill, or the other Godfathers of Economics, but Smith, Ricardo, Mill and others had a home bias perspective on global trade. Why did they have a home bias? Because they understood that relatively liberal trade is desirable, but corporations and investors destroy their home economies when they disregard their home societies. This is what many of the largest American-in-name-only transnational corporations have done since the 1980s. And it was in reaction to this observation that Adam Smith invoked his “invisible hand” phrase.

Specifically, based on the assumption that capitalists would be loyal to their home country, Smith believed capitalists would be guided by an invisible hand that would naturally compel them to support their domestic economies. In Smith’s own words:

David Ricardo also said that capitalists should “be satisfied with the low rate of profit in their home country. . . .”[14] Based on their hostility to American workers, tax-dodging, and threats of corporate inversion, many of the largest transnational American corporations have deviated far from the home bias assumptions that were foundational to the free-trade principles conceived by our Economic Godfathers.

Adam Smith Warned Against Harmful Wealth Concentration. Smith assumed that free markets would distribute wealth relatively equitably (i.e., “in nearly the same distribution” and “into equal portions”) throughout each national population, which neoliberals conveniently ignore and deny with vague notions of winners and losers. Smith’s perception of “winners and losers” did not include wealth gaps that are 5-7 orders of magnitude (i.e., up to 10,000,000 times) between the net worth of average Americans vs. the wealthiest Americans today.[15] The gap is even larger if we include the poorest Americans or the poorest people in all countries, which pushes the wealth gap another order of magnitude higher, i.e., the wealthiest humans have up to 100,000,000 times more wealth than the poorest humans on Earth.

In his 1759 book, The Theory of Moral Sentiments, we can see that Smith understood the critical importance of broad-based wealth creation and distribution when he said:

Smith explicitly warned against squeezing the Middle Class and allowing wealth to concentrate into the hands of a few. In his own words:

Amorality Check. For people who prefer to keep morality out of economic policy discussions, let’s be clear: These are not merely normative or moral concerns. Adam Smith, Smithians in general, and this book discuss some of the problems associated with wealth concentration because excessive wealth concentration is always harmful to the integrity and structure of societies, economies, and democracies. There’s nothing wrong with becoming “rich,” but when obscene wealth and obscene poverty are allowed to coexist within the same capitalistic economy, it means that economy has deviated from the original purpose of capitalism, as perceived by Adam Smith.

What Does “Rich” Mean? For our purposes here, the phrase “rich” can be defined as “any culturally acceptable multiple of the median net worth in a given society.” A “rich” human with a net worth that is hundreds or even tens of thousands of times higher than the average net worth is probably culturally acceptable in most capitalistic societies today, but in the U.S., we have humans with a net worth that is millions of times higher than the average. Concurrently, neoliberals have been dismantling all the social stability programs upon which an increasingly impoverished American population depends. These economically inequitable and socially unjust outcomes are only possible within the context of a broken political system. In fact, this wealth gap creates consequences domestically and globally that look more like medieval feudalism than Adam Smith’s conception of capitalism.

Consistency Check. Anybody can invoke the name of Adam Smith or his Invisible Hand to justify their trade and economic policies, but it’s reasonable to expect them to be logically consistent. That means acknowledging Smith’s explicit exhortations to construct societies and economies that are socially and economically sustainable, which means implementing policies that result in much more evenly distributed income and wealth than we see in the United States and around the world today.

Adam Smith’s Perspective on Self-Interest. Smith is often unfairly derided by many people because they take his comments about self-interest out of context. When Smith said, “It is not from the benevolence of the butcher, the brewer, or the baker, that we can expect our dinner, but from their regard to their own interest,” he was making a simple, factual observation about the way every relatively free market works.[18] A free market cannot function without human free will and personal liberty to pursue the ideas that inspire humans to innovate and prosper through commercial production and exchange.

Self-Interest is Not a Virtue. In that same section of The Wealth of Nations, Smith was also making a pragmatic philosophical point about how people should not feel ashamed if they have personal goals and ambition, but he was not elevating self-interest to the highest virtue of humanity like Ayn Rand did in her book, Atlas Shrugged. Entire generations of capitalists and financial service professionals have grown up believing that Adam Smith really believed self-interest is a moral virtue. They would have been quickly relieved of this false perception if they had actually read any of his books or attended any of his university lectures on Moral Philosophy, Natural Theology, and Ethics.

It’s also useful to see the full context of Smith’s “invisible hand” comment because it reveals how careful and qualified he was with his words about self-interest.

Self-Interest Alone Does Not Produce Optimal Outcomes. Notice in the quote above that Smith clearly uses the words “many” and “frequently” to describe the frequency of positive outcomes that can occur from manifestations of human self-interest. He does not use the words “always” or “every time”—he does not even say “a majority of the time.” In fact, nowhere in his writings does Smith say that self-interest always leads to optimal market-based outcomes. Thus, when neoliberals say that self-regulated markets driven by human self-interest alone are the only path to an efficient economy, they’re distorting the spirit and intent of Smith’s entire body of morally-centered, humanistic, socioeconomic scholarship.

Adam Smith Was Not a Heartless Capitalist. Based on the preceding false perceptions, many people have incorrectly assumed that Adam Smith was a heartless capitalist with little or no regard for the plight of the general public. Nothing could be further from the truth. In fact, the first major book that Smith wrote was The Theory of Moral Sentiments, in which he stated:

Adam Smith Placed Ethics Above Economics. When Smith was the Chairman of the University of Glasgow in Scotland, he explicitly prioritized his lecture sequence in the following order: Natural Theology, Ethics, Jurisprudence, and then Economics. This sequence was intended to give his students an ethical foundation and societal awareness before they learned about Economics.[20] Smith also frequently lectured on the virtues of charity and the need to support people in poverty, orphans, and others who suffer from undeserved misfortune. And he was not only talking about voluntary charity; as we have already seen, Smith explicitly endorsed corporate taxation as a necessary fundraising mechanism to take care of destitute humans and stabilize communities as the merchant guilds in Europe and China did for hundreds of years before he wrote The Wealth of Nations.

Adam Smith’s Hostility to Government Intervention. Smith’s hostility to government intervention was explicitly directed at the harm caused by Mercantilism, which was the dominant socioeconomic system on Earth prior to and during much of Smith’s life. By definition, Mercantilism is a socioeconomic system in which governments use trade and currency barriers to control all market activity because they perceive international trade as a zero-sum game, rather than a dynamic pie that can be expanded with more economically liberal trade practices. However, there is nothing in Adam’s Smith’s writings that equates the pragmatic desire for “more liberal trade” with “no government intervention whatsoever!” To the contrary, Smith was not averse to government intervention when it is necessary to correct market failures that reduce sub-national human welfare.[21]

Adam Smith Cared About Socioeconomic Ecosystems. Smith’s quotes above are reflective of how thoughtfully he considered the many ways that capitalism impacts human societies. Clearly, he was not merely interested in production and profit; to the contrary, he was deeply concerned about the economic and social ecosystems in which corporations operate. He understood that maximizing production and profit are important, but not sufficient alone, to maximize human welfare. That’s why he believed it is sometimes necessary for governments to intervene in markets to prevent market failures and for corporations to allocate some of their profits (in the form of taxes) to contribute to the maintenance of their socioeconomic ecosystems.

The Birth of Modern Capitalism. The original field that Adam Smith invented was “Political Economy,” which explicitly embraced the inseparable relationship between politics and economics. This duality between politics and economics is woven throughout all of Adam Smith’s work. In fact, this was the perspective that Smith had when he coined the phrase, “capitalism.” However, most of the political and sociological analysis that is inherent in every socioeconomic system—including capitalism—was pushed to the fringes of the Economics profession by the early 20th Century. This is when corporations started hiring economists to write textbooks and research reports that focused only on the “economics,” while ignoring the “politics.” But this is like focusing on only one side of a coin or one side of a planet and then claiming to know everything about the other side. This one-sided perspective of the world became the basis for “Neoclassical Economics,” which has dominated the Economics profession in the U.S. and much of the world since the beginning of the 20th Century.[22]

Notes:

[1] Smith, Adam. (1776). The Wealth of Nations. Book I, Chapter VIII.. para 13.

[2] Smith, Adam. (1776). The Wealth Of Nations, Book IV, Chapter VIII, p. 145, paras. c29-30.

[3] Smith, Adam. (1776). The Wealth Of Nations, Book V, Chapter I, Part II, 775.

[4] Smith, Adam. (1776). The Wealth Of Nations, Book I, Chapter X, Part II.

NOTE: This passage is also consistent with the medieval guilds that raised taxes to care for the families of the guild members when they were destitute or otherwise incapable of surviving without community support from the guild. The guilds were highly integrated economic, social, political, and spiritual communities, which had a much more holistic perspective on how to organize communities than Neoliberals do today.

[5] Smith, Adam. (1776). The Wealth Of Nations, Book V, Chapter 2, Part II. It’s also important to note that he is not talking about income taxation. He explicitly says, “a tax upon house-rents” because he was opposed to any form of income tax because it punishes productive activities.

[6] Smith, Adam. (1776). The Wealth Of Nations, Book V, Chapter I, Part IV.

[7] Ibid.

[8] Ibid.

[9] Notice that Smith said nothing about privatizing roads with private toll-collecting corporations. We will discuss the issue of privatizing public infrastructure later.

[10] Smith, Adam. (1776). The Wealth Of Nations, Book V, Chapter I, Part IV.

[11] Ibid.

[12] Smith, Adam. (1776). The Wealth Of Nations, Book IV, Chapter 2, para 39.

[13] Smith, Adam. (1776). The Wealth Of Nations, Book IV, Chapter 2, para 9.

[14] Ricardo, David. (1821). On the Principles of Political Economy and Taxation. Chapter 7, para 19.

[15] There is a magnitude range here because net worth can be calculated several different ways.

[16] Smith, Adam. (1759). The Theory Of Moral Sentiments, Part IV, Chapter I, pp.184-5, para. 10.

[17] Smith, Adam. (1776). The Wealth Of Nations, Book I, Chapter 8, para 35.

[18] Smith, Adam. (1776). The Wealth Of Nations, Book I, Chapter 2, para 2.

[19] Smith, Adam. (1759). The Theory Of Moral Sentiments, Part I, Chapter I, para. 1.

[20] Smith, A., & Wightman, W. P. (1982). The Glasgow Edition of the Works and Correspondence of Adam Smith: 3. Indianapolis: Liberty Press.

[21] See the definition and discussion of “market failure” later.

[22] Note: “Neoclassical Economics” is associated with the body of technical economic theories that emerged early in the 20th Century; whereas, “neoliberalism” is a more general ideology that has dominated international trade and economic development policies since the 1980s.

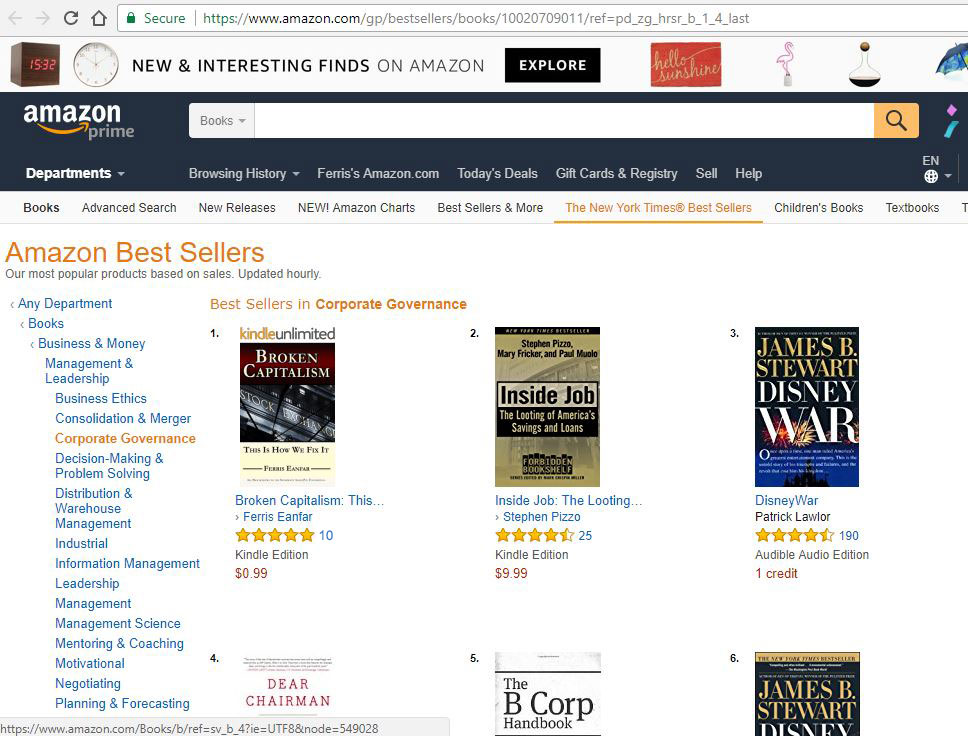

About Ferris Eanfar

Ferris Eanfar has over 20 years of experience in technical, financial, media, and government intelligence environments. He has written dozens of articles and several books in the fields of Economics, Crypto-Economics, and International Political Economy, including Broken Capitalism: This Is How We Fix It and GINI: Capitalism, Cryptocurrencies & the Battle for Human Rights and the Global Governance Scorecard. Ferris is a cofounder of the Gini Foundation, which builds unique cryptocurrency systems to protect human rights, among other benefits; and the CEO of the AngelPay Foundation, a nonprofit financial services company with a mission to “return wealth and power to the creators of value.” To learn more about Ferris, please visit the About Ferris page.Visit Ferris on:

Gini Website Coming Soon. We (

Gini Website Coming Soon. We (