To understand the purpose and value of our Gini Blockchain and why it’s different from any other blockchain, it’s useful to review why several fiat currency economies are collapsing in many countries today.

Economic Power = Political Power. Wealth concentration creates distortions in an economy because it gives certain groups enough economic power to control or substantially shape the laws and regulations that determine how economic transactions are defined and executed, which determines how value, income and wealth are distributed throughout the economy. This is the mechanism by which economic power is converted into political power. Certain industries, especially the FIRE (Finance, Insurance, and Real Estate) industries, disproportionately benefit from this mechanism because their income- and wealth-generating capacity is almost completely dependent upon how laws and regulations are written and enforced. In fact, they generally do not produce anything; they simply act as intermediaries between counterparties within an economy. Thus, the FIRE industries have strong incentives to convert their economic power into political power so that they can control the laws and regulations to channel as much wealth as possible from the real economy into their own pockets.

FIRE Assets Fuel Unsustainable Economic Bubbles. In contrast to the FIRE industries, most other industries and groups in developed countries have suffered from severely eroded economic and political power since the early 1980s. These problems in many countries today are illustrated in numerous data sets, including the steep declines in the labor force participation rate as FIRE industries have shifted capital flows away from productive industries like manufacturing to speculative FIRE industries. Shifting capital away from productive industries into speculative FIRE industries has resulted in skyrocketing private debt levels and unsustainable economic bubbles, which benefit the FIRE industries at the expense of stability and sustainability in the broader economy. This is only possible in an economy that has no mechanisms to create ecosystem balance.

FIRE & Wealth Concentration Is Not the Result of Free Markets. By substantially controlling the creation and enforcement of laws and regulations, FIRE industries control the flow of capital throughout an economy. Since capital is required to create most forms of economic value, controlling the flow of capital enables FIRE industries to control the flow of income and wealth throughout the economy. Controlling the laws and regulations to control the flow of capital, income, and wealth is not the outcome of free-market capitalism; it’s the inevitable result of insufficient resistance against ecosystem-killing concentrations of economic and political power in the hands of a small number of groups. In this case, we’re talking about the FIRE industries, but every for-profit entity within an economy has irresistible incentives to use their economic power to control and/or influence the laws and political system to steer the flow of capital and wealth toward themselves.

About Ferris Eanfar

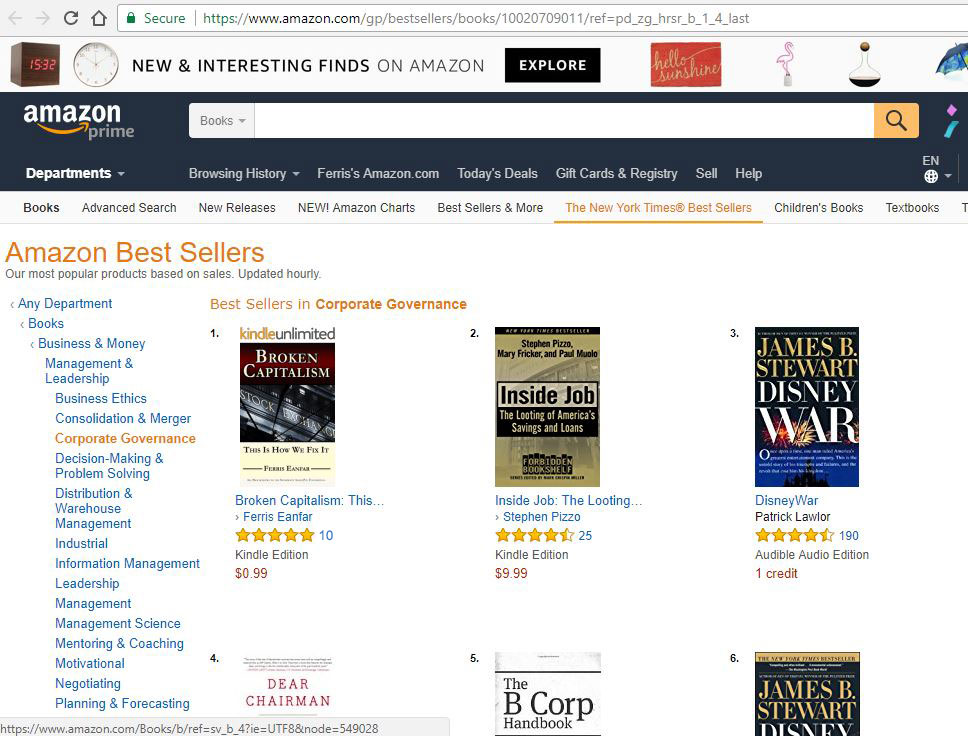

Ferris Eanfar has over 20 years of experience in technical, financial, media, and government intelligence environments. He has written dozens of articles and several books in the fields of Economics, Crypto-Economics, and International Political Economy, including Broken Capitalism: This Is How We Fix It and GINI: Capitalism, Cryptocurrencies & the Battle for Human Rights and the Global Governance Scorecard. Ferris is a cofounder of the Gini Foundation, which builds unique cryptocurrency systems to protect human rights, among other benefits; and the CEO of the AngelPay Foundation, a nonprofit financial services company with a mission to “return wealth and power to the creators of value.” To learn more about Ferris, please visit the About Ferris page.Visit Ferris on:

Gini Website Coming Soon. We (

Gini Website Coming Soon. We (