Bank of America has more blockchain patents than any other company on Earth, including IBM, Google, Facebook, and other Silicon Valley tech companies (Bloomberg). JPMorgan and Wells Fargo also have a relatively large number of blockchain patents. And banking corporations in general have already collected a large percentage of total issued blockchain patents. Why?

I think there are three primary reasons: (1) They understand the value of blockchain in reducing their operating expenses; (2) their existing systems and software code bases are atrocious and obsolete (I’ve worked in FinTech for a while so I know this is true.); and (3) they are weaponizing their patent portfolios in preparation to attack open source blockchain platforms in the future.

Many people assume that open source projects are immune to patent litigation, but they are not. Patent lawsuits are rarely filed against open source projects simply because most open source projects have no significant money to pay damages; so, it’s not economically justifiable for most patent-holders to sue.

Additionally, many patent-holders are consumer-focused corporations that do not want the negative publicity associated with being the “big bad patent troll.” However, banks are different. They’re accustomed to being reviled as evil monsters and they don’t usually care because they know they can buy politicians to undermine their competitors and preserve their power. This has made the too-big-to-fail banks essentially immune to negative publicity and the court of public opinion.

Additionally, in the case of open source blockchain projects that have successfully funded their operations with ICOs and self-sustaining blockchain-based treasuries, they actually have very significant resources, which makes them much more attractive patent litigation targets. This makes patent litigation a more serious risk for cryptocurrency projects than other projects managed by the Apache Foundation, Mozilla Foundation, etc.

Patent litigation is potentially a very disruptive problem for any blockchain project. The banking lobby is notoriously vicious and corrupt with enormous financial and political influence over the U.S. regulatory, legislative, and financial systems. So, whenever we find high-quality projects that we believe in, we should support them with our money and our nonpartisan political support whenever possible.

About Ferris Eanfar

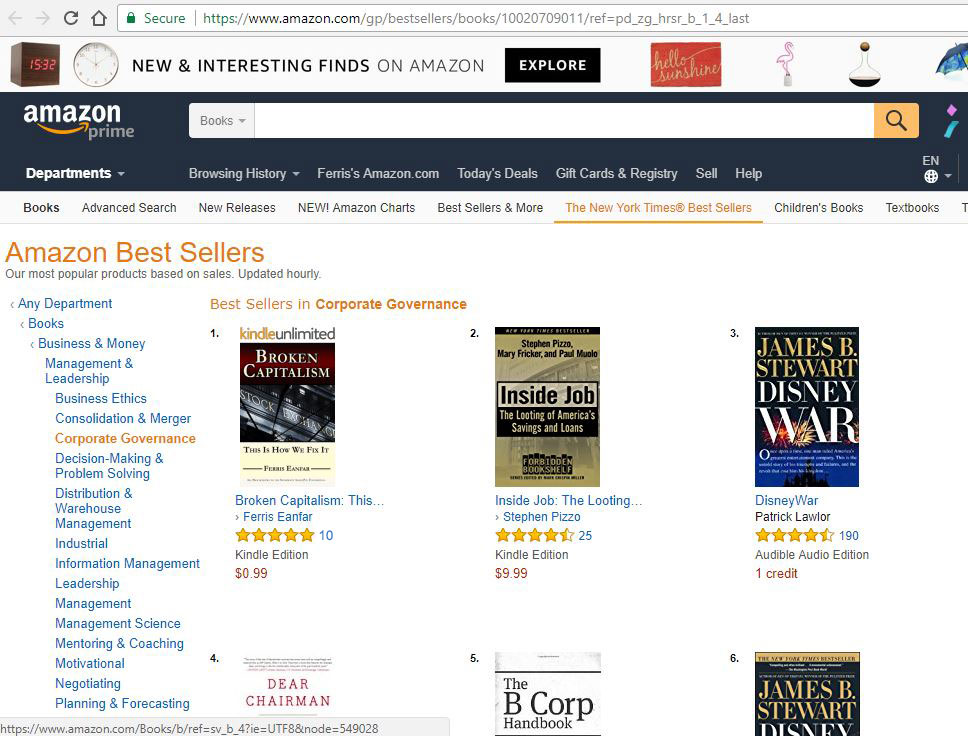

Ferris Eanfar has over 20 years of experience in technical, financial, media, and government intelligence environments. He has written dozens of articles and several books in the fields of Economics, Crypto-Economics, and International Political Economy, including Broken Capitalism: This Is How We Fix It and GINI: Capitalism, Cryptocurrencies & the Battle for Human Rights and the Global Governance Scorecard. Ferris is a cofounder of the Gini Foundation, which builds unique cryptocurrency systems to protect human rights, among other benefits; and the CEO of the AngelPay Foundation, a nonprofit financial services company with a mission to “return wealth and power to the creators of value.” To learn more about Ferris, please visit the About Ferris page.Visit Ferris on:

Gini Website Coming Soon. We (

Gini Website Coming Soon. We (