The UK will leave the European Union. It’s usually not wise to make absolute statements when discussing complex future economic and political events. However, sometimes the empirical data is so overwhelming that the outcome is relatively easy to predict if we ignore all the propaganda and noise in the media. The following chart illustrates the first nail in the EU’s coffin.

The Eurozone Drags Down Europe’s Economic Stars

Source: Bank of America Merrill Lynch Global Research, ONS.

Key UK Economic Facts (as of 1 June 2016):

- The UK unemployment rate is about 5%, which is as good as any major economy can expect in the modern world.

- Inflation is low.

- Real wages have been stable for years. (Although this will change soon no matter what happens with Brexit.)

- The London banking center enjoys a unique position in global trade and finance.

The following chart illustrates how strong the UK’s economic position is relative to all other EU nations.

(Note: UK Data is from February 2016 because later data was not available.)

(Note: UK Data is from February 2016 because later data was not available.)

The Eurozone is Not a “Single Market” or a “Union”. There is a sobering reality implicit in the chart above: Despite the propaganda from Brussels and London, the EU has never been—and will never be—a so-called “single market” or a “union.” Every nation within the EU has a unique cultural and economic identity. They all have unique strengths and weaknesses in manufacturing, agriculture, and technological development. They all have different collective work ethics, varying levels of institutional integrity, fiscal discipline, tax policies, and cultural values. Under these highly fragmented conditions, there is no humanly possible way to impose a uniform set of trade, fiscal, tax, and monetary policies upon all 28 Eurozone nations.

Uncovering the Fantasy to See the Dark Reality. For many years the dark secret of the EU was that Germany was the economic glue keeping everything together. After the Euro Debt Crisis blew up in 2009, the secret became obvious to the world. However, the secret also applies to the UK. Both Germany and the UK give billions more Pounds and Euros to Brussels every year than they receive. From a political perspective, this is intolerable in Germany and the UK, but it’s a bit more economically tolerable in Germany because Chancellor Merkel has managed (so far) to convince a majority of the German people that EU membership is a net benefit to Germany.

EU Cracks Will Become Gaping Chasms. There is a high probability that Brexit will be the beginning of a series of referendums throughout Europe, including in Germany. The reason is clear: NATO is intended to protect Europe from foreign invaders (unless they’re guerrilla war-fighting jihadis), but nothing protects the EU from self-inflicted economic suicide. The only way to cure the perpetual debt crises and economic malaise in Europe is to unleash real economic competition. This means allowing each country to manage its own monetary, fiscal, trade, and capital markets policies.

Economic “Policy Harmony” Does Not Create Evenly Distributed Prosperity. In theory it sounds logical to “harmonize” trade and economic policies across the entire planet. However, politically-driven harmony always benefits large corporations who are able to use their financial power to influence the policymakers who control how the harmony actually works. This gradually and inevitably steers the harmonization process in ways that give the largest companies greater cumulative benefits over time. The result is systematic wealth distribution from the poorest to the richest members of a harmonized society.

The Trojan Horse of Economic Policy Harmony. Economic policy harmony is typically pitched to citizens as a way for governments and private organizations to achieve cost benefits derived from “frictionless” economies of scale. Governments and large corporations promise their constituents that these benefits will “trickle down” to the masses in the form of lower taxes and lower prices. Unfortunately, after the largest companies achieve the cost benefits, they invariably keep the vast majority of the savings. Then they use their increased wealth to influence the political system to obtain even more unfair advantages over their smaller competitors.

Large Centralized Bureaucracies Destroy Small Companies. Since 2010, the technocrats in Brussels have created more than 3,500 new laws affecting UK companies. Based on most estimates that I’ve seen, all this new regulation costs the UK at least $10 billion per year. It may seem paradoxical to some people, but many senior executives in large companies actually love regulations. In fact, they often lobby their politicians to create ever-more regulations and compliance requirements so that the bureaucratic burden expands beyond the capacity of smaller firms to manage cost-effectively, thereby pushing them into bankruptcy. This is exactly what has happened in the EU and in the United States.

Currency Inflexibility is the Root of All Eurozone Evil. For real EU companies that don’t have the ability to employ financial engineering techniques to mitigate differential currency value risks, the stranglehold of the Euro chokes the life out of their businesses. They can’t adjust the true cost of their domestic goods and services to make their exports more attractive and compete more effectively with companies in higher-cost jurisdictions. This creates a downward spiral of declining economic activity, which cripples their governments with inflexible monetary policies, interest rates, and perpetually growing toxic debt, reducing their countries to the level of third-world street beggars.

The Refugee Crisis. Only 22% of UK citizens approve of the way the Brussels-based European Parliament has managed the refugee crisis. The following chart was produced from a Pew Eurozone poll that asked, “Do you (Approve/Disapprove) of the way the European Union is dealing with the refugee issue?”

The Economy & Debt Crisis. Only 28% of UK citizens approve of the way the European Parliament has handled the EU economy. The following chart was produced from a Pew Eurozone poll that asked, “Do you (Approve/Disapprove) of the way the EU is dealing with European economic issues?”

The Sovereignty Crisis. When the UK joined the EU in 1973, it had 20% of the voting power in the European Parliament. Today it has less than 10%. Between 2009 to 2014, over 84% of the laws passed by the European Parliament were opposed by the UK Parliament. Based on all the polling data, it’s clear that a majority of UK citizens (especially outside London) do not want to subordinate their sovereignty to unelected bureaucrats in Brussels. Laws imposed by foreign powers always seem divorced from domestic realities. This is the predictable outcome of every experiment with centralized planning; so the inevitable disintegration of the EU should not surprise any reasonably astute student of history.

Only a Banana Republic Would Stay in the EU. With an accurate understanding of the cultural realities, economic imbalances, and polling data, how could any political or economic pundit anywhere in the world today seriously believe that a truly free and fair UK referendum could ever lead to the UK staying in the EU? The only conceivable way that the UK will still be in the EU on 24 June 2016 (the day after “Brexit Day”) is if the London establishment transforms the UK into a banana republic and stuffs the ballot box full of “Remain” banana peels.

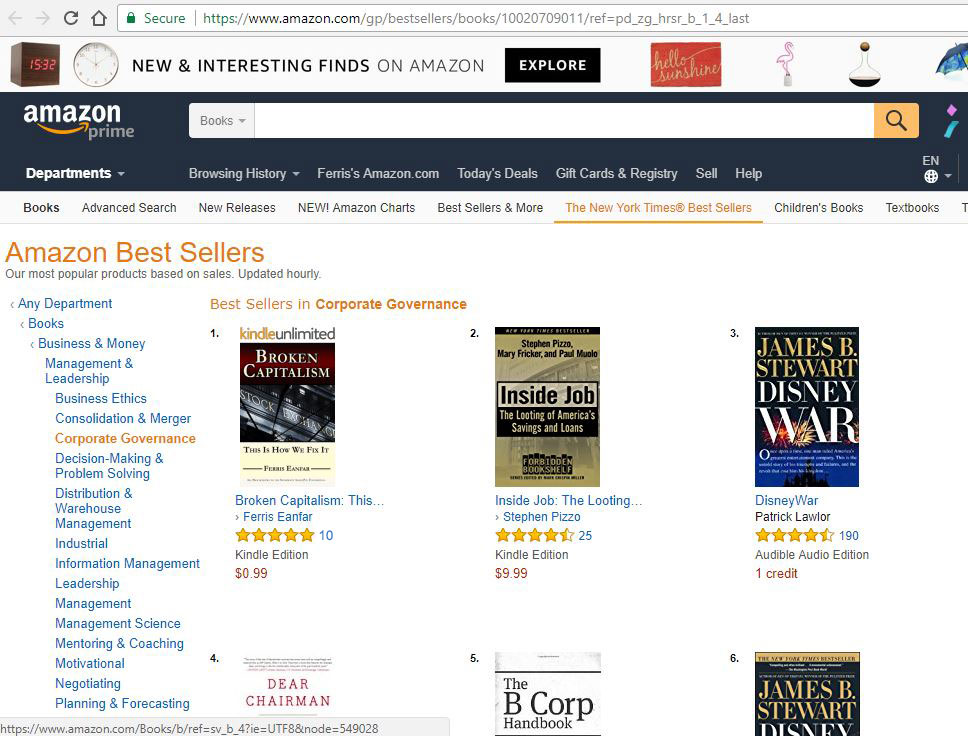

About Ferris Eanfar

Ferris Eanfar has over 20 years of experience in technical, financial, media, and government intelligence environments. He has written dozens of articles and several books in the fields of Economics, Crypto-Economics, and International Political Economy, including Broken Capitalism: This Is How We Fix It and GINI: Capitalism, Cryptocurrencies & the Battle for Human Rights and the Global Governance Scorecard. Ferris is a cofounder of the Gini Foundation, which builds unique cryptocurrency systems to protect human rights, among other benefits; and the CEO of the AngelPay Foundation, a nonprofit financial services company with a mission to “return wealth and power to the creators of value.” To learn more about Ferris, please visit the About Ferris page.Visit Ferris on:

Gini Website Coming Soon. We (

Gini Website Coming Soon. We (