Dangerous Products Should Have Warning Labels. Products that come with plastic bags that can suffocate and kill children have warning labels. Economic policies that can suffocate and kill a country’s economy should also have warning labels. For example, “Warning: Risk of Death to Your Economy” should be the label on all globalist economic policies. And like all products that are manufactured for human consumption, the product packaging of globalist economic models and policies should also include a prominently displayed list of ingredients and usage instructions. This list should include all the economic and political assumptions, conditions, and their consequences for a country that will likely occur if those assumptions and conditions are not perfectly valid for any reason.

The Plague of Economic Ignorance in Government. One of the biggest problems that exists in the world today is the ignorance that most politicians have about the way their economies work and how international trade works in the real world. They have no idea how to differentiate between a good or bad economic policy unless at least one of these two conditions exist:

(1) They have real-world experience building companies that operate in global markets; and

(2) they have taken advanced college courses in economics to learn the vocabulary and analytical tools that economists use to create their international trade models, upon which all globalist arguments and economic policy prescriptions are constructed.

Without at least one of these two conditions being true, politicians are forced to depend on the “business expertise” of self-serving multinational corporations and the “objective analysis” of economists, many of which are tainted by deep ideological bias and/or captured by corporate interests. The result is a circus of the blind leading the blind as the ambition of politicians, multinational corporations, and globalist economists feed off of each other to produce economic policies that distort reality to achieve their own interests at the expense of all the people who suffer from their ignorance and self-serving policy prescriptions.

Economic Policies Based on Autarky vs. Globalism. The basic principles of supply and demand, marginal utility, and even comparative advantage within the context of a single national economy are all useful and valuable to understand. These basic principles alone are usually sufficient to guide policymakers when it comes to domestic economic policies. This is because these basic principles are generally all that is needed to effectively model and understand the reality of how domestic markets and economies work in “autarky”, i.e., without any international trade.

The Deep, Murky Oceans of International Trade. In contrast to the basic economic concepts above, when policymakers start wading into deeper economic principles of international trade like General Equilibrium Models, the Ricardian Theory of Comparative Advantage, Heckscher-Ohlin Model, Stolper-Samuelson Theorem, and all their corresponding unrealistic assumptions, policymakers are often deceived by an illusion of scientific rigor. They don’t realize that these globalist economic models are incapable of capturing the reality of real-world global economic phenomena. The result is false confidence in their models, which leads to false confidence in their policies.

Examples of Reasonable and Rational Assumptions. Economists make many assumptions to make their models work. Some of these assumptions are reasonable and rational because they make it possible to predict certain types of economic phenomena without catastrophically distorting the policy outcomes of their models and disconnecting themselves from reality. These benign assumptions include things like:

- limiting the scope of analysis to a narrowly defined set of products or economic actors to analyze the impact of economic policies on those particular products and actors;

- limiting the scope of analysis to a particular market or factor of production to analyze policy impacts on those particular variables;

- assuming most people prefer more of a good than less;

- focusing on a narrow area of economic activity while holding other variables constant to test the impact that a change in one variable might have on one or more other variables, among others.

Those are all examples of reasonable and rational assumptions that simplify small sections of the real world so that economists can develop insights that may be useful in developing targeted economic policies specifically for particular segments of a domestic economy.

Examples of Unreasonable and Irrational Assumptions. In contrast to the reasonable and rational assumptions above, economists, politicians, and multinational corporations that promote globalist trade policies make several unreasonable and irrational assumptions that egregiously distort reality and destroy the credibility of their economic models and global policy prescriptions. For example, consider the following dangerous and absurd assumptions (“AA”s) that are required by all globalist economic models.

- AA: All economic agents (corporations, consumers, governments, etc.) exhibit rational behavior.

- AA: Factors of production are fixed, i.e., labor and capital cannot move between countries.

- AA: Factors of production are perfectly mobile between industries within a country, i.e., labor and capital can easily move between industries within a country.

- AA: There are no barriers to free and fair trade, i.e., domestic and international politics and special interest groups do not exist.

- AA: There are no negative externalities associated with production or consumption, i.e., there are no negative consequences from environmental pollution, resource depletion, social and cultural destruction, moral hazards, national security risks, or any other negative consequences.

- AA: Perfect competition exists within and between countries.

- AA: Community preferences reflect collective individual preferences and can be sufficiently represented by community indifference curves.

- AA: Trade between countries will always be balanced because exports must pay for imports; thus, exports will always be equal to imports.

- AA: The flow of wealth between countries will always be balanced over the long-run. (Based on the previous assumption.)

- AA: Per-capita GDP reflects the distribution of wealth within a country.

- AA: Production gains from specializing in a country’s comparative advantage industries result in more per-capita GDP, more per-capita wealth, higher per-capita consumption, and higher per-capita quality of life for everybody in all countries over the long-run. (Based on the previous assumption.)

Who Really Believes All Those False Assumptions? For any globalist economic policy to work for the majority of Americans, all the assumptions above must hold true. Yet, for anybody with real-world business experience, the assumptions above are so obviously absurd that it’s difficult to believe that any American who truly understands how international trade works would ever publicly associate their name with a globalist economic policy.

Defective Products. Globalist policies and the economic models used to support them are the defective products that multinational corporations, their captured economists, and their ignorant political zombies in Washington have been selling to the American people for decades. An entire article could be written about each one of the assumptions above, why they seriously erode the credibility of globalist economic models, and how each assumption leads to serious adverse consequences by ignoring crucial socioeconomic and geopolitical realities. But for now, let’s focus on a few final principles to wrap up this article.

Economic Models Are Not Like Roadmaps. Economists often defend their economic models and globalist policy prescriptions by saying things such as, “Like roadmaps, economic models are not intended to capture the full reality of any economy; they are only intended to be abstractions of reality to serve as guides to help predict economic phenomena.” Most economists say this with good intentions, but the comparison between roadmaps and economic models is far too benign and falls far short of capturing the destructive capacity that bad economic models have on the governments that follow them. To put this into perspective, let’s examine a few of the most significant differences between a roadmap and the globalist economic models that have guided American policymakers for generations.

- Roadmaps Do: Simplify reality by ignoring geographical features of the planet that are irrelevant to the traveler because those features do not interfere in any way with the traveler’s ability to travel from point A to point B on the map. Roads that are straight on the map are straight in reality; roads that are curved on the map are curved in reality. Thus, we can reasonably and rationally assume that calculating the time and distance between each point on a roadmap will enable us to effectively navigate the real world and make highly accurate predictions about the best path to take between point A and point B on the map and the corresponding locations in the real world.

- Roadmaps Do Not: Depend on at least a dozen unreasonable assumptions that reduce the reality of the real world to a nonsensical fantasy that renders them useless and dangerous in the real world. Mountains, oceans, roads, and lakes on a roadmap don’t irrationally and unexpectedly shift their position based on the ideology and political ambition of each new government administration. No matter how powerful they are, multinational corporations can’t use a roadmap to secretly re-route an interstate freeway across the Grand Canyon to serve their corporate shareholders. The politically tainted glory of a Nobel Prize in Economics does not suddenly make one roadmap more accurate than all the others. Roadmaps do not impose themselves upon our communities, destroy our wealth, decrease our quality of life, and ignite violent revolutions when they occasionally fail to capture an important feature of reality (e.g., a new construction zone that causes us to be 20 minutes late for an appointment).

- Globalist Economic Models Do: Distort reality by ignoring the most consequential features of our geopolitical world that actually produce economic reality. This makes it virtually impossible for a country to travel from economic point A to economic point B unless the country is cheating and defying World Trade Organization rules at every possible point along the country’s growth curve; or, unless the country is the beneficiary of transnational structural monetary policies that give the country an unfair competitive advantage by enabling the country to manipulate the terms of international trade and/or avoid the consequences of dangerous bank debt accumulation. Examples of these unfair structural advantages are the U.S. Dollar’s reserve currency status and the European Union’s monetary policies that result in huge EUR surpluses in Germany’s banks because none of the other EU countries can adjust their currency exchange rates to make their products and services more competitive.

- Globalist Economic Models Do Not: Provide benign, simplified, nonpartisan versions of real-world economic reality. They do not take into account the most influential geopolitical and socioeconomic factors that actually produce economic outcomes in the real world. They do not reliably predict quality-of-life outcomes for the vast majority of humans in any country. They are not used as objective tools by policymakers to make complex decisions about how to allocate scarce resources in any country. They do not reasonably or consistently predict real-world outcomes in international trade beyond the most simplistic country-level of analysis; and even then, certainty in predicted outcomes is severely limited to only the most rudimentary predictions of supply and demand of basic goods and services, which reveals virtually nothing about the actual distribution of wealth, the quality of life of a country’s citizens, stability of a given society, or the health of a given economy in the real world.

Unlike Roadmaps, Economic Models Can be Used as Weapons. Economic models are only useful to the degree that they can predict real-world economic phenomena to help government policymakers make decisions that enhance the quality of their citizens’ lives. If an economic model has obvious flaws, is based on absurdly unrealistic assumptions, or can be used in ways that violate its intended purpose, then the model can easily become a weapon that destroys wealth and human life. This is no different than a gun: A gun is a dangerous tool that can be used for defensive or offensive purposes. When a gun is used offensively, it is a crime when people are harmed. The same should be true for economic policies and their underlying economic models whenever they are revealed to be destructive to the health and welfare of a nation and its citizens.

Recall the Defective Product of Globalism. The theoretical benefits of Adam Smith’s principle of Absolute Advantage and David Ricardo’s principle of Comparative Advantage conceived 200 years ago do not materialize when a country’s own corporations are actively working to eliminate their own country’s absolute and comparative advantages. For example, the United States is well-known for its technological prowess, which should have enabled it to produce and deliver most goods more efficiently than any other country in the world. This means the lower labor expense in developing countries should be offset by higher productivity in the U.S., which should enable U.S. manufacturers to remain competitive and keep jobs in the U.S. This is how globalists sold the defective product of globalism to the American people. This defective product must be recalled and sent back to the fabrication factories (Congress, White House, and multinational corporate boardrooms) that produced it. Americans should demand rational international trade policies that are not crippled by absurd assumptions, political ambition, and special interest corruption.

The Economic Consequences of Disloyalty. As discussed previously (see also: Transnational Cannibals and The Mechanics of a Global Wealth Transfer), U.S. multinational corporations have actively and systematically worked to transfer U.S. technology and manufacturing skills to foreign countries to increase their corporate shareholders’ wealth. This means they have actively and systematically destroyed the very comparative advantages that would have allowed the U.S. and all its citizens to compete globally in a far greater number of industries than they can today. This is another huge flaw in globalist economic models: They completely and conveniently ignore the catastrophic impact of disloyal multinational corporations, which undermines one of the most absurd assumptions (fixed factors of production) of globalist economic models.

Political Elites Don’t See It Because the Status Quo Serves Them. Despite his flaws, at least Donald Trump seems to understand the most obvious causes of America’s economic decline: the toxic dysfunction of America’s political class and the catastrophic disloyalty of American multinational corporations. This is why he will likely win the presidential election next month, despite all the noise and propaganda in the mainstream media today. Indeed, Trump has the potential to do more to help the American economy and its people than all the establishment politicians and economists in Washington today. (See also The Rise of Nuclear Trump if you’re afraid of his foreign policy.)

Do We Have Any Justification for Hope? To be clear, the U.S. electoral system needs to be completely overhauled to ensure long-term reforms have a chance to take root. However, over the next 4-8 years, the next president can use the bully pulpit of the Oval Office to shine a sterilizing bright light on Congress to compel our elected representatives to act relatively independently of their special interest overlords just long enough to shift the public focus to the true causes of America’s decline. If the next president can do that, then perhaps we might have some small, justifiable hope that conditions in the U.S. will change for the better before they get too much worse for the majority of Americans.

About Ferris Eanfar

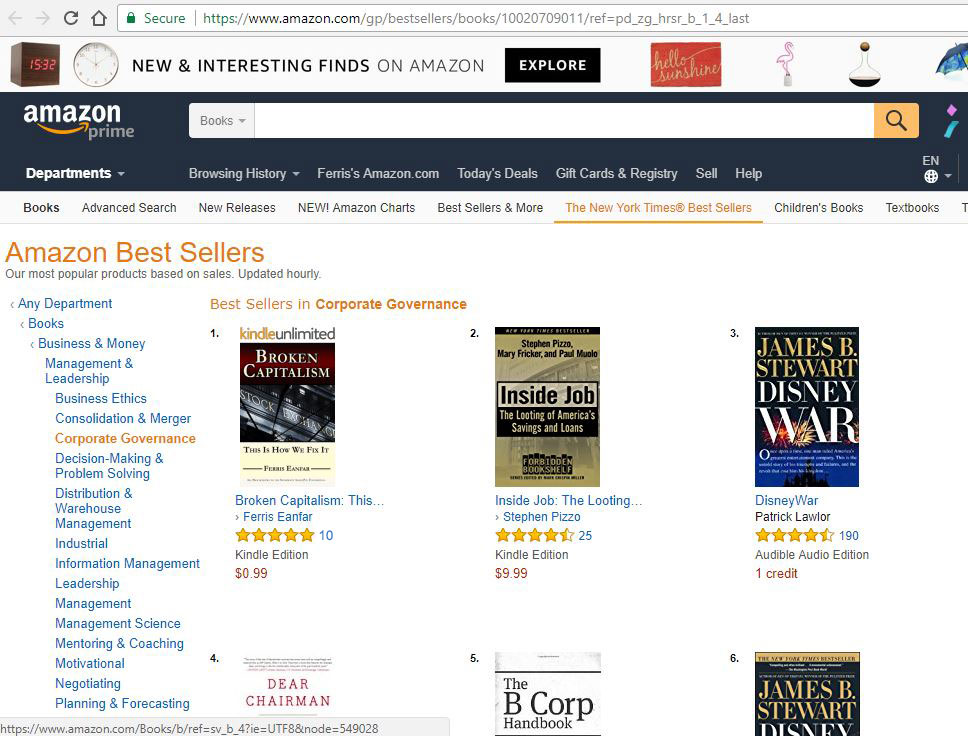

Ferris Eanfar has over 20 years of experience in technical, financial, media, and government intelligence environments. He has written dozens of articles and several books in the fields of Economics, Crypto-Economics, and International Political Economy, including Broken Capitalism: This Is How We Fix It and GINI: Capitalism, Cryptocurrencies & the Battle for Human Rights and the Global Governance Scorecard. Ferris is a cofounder of the Gini Foundation, which builds unique cryptocurrency systems to protect human rights, among other benefits; and the CEO of the AngelPay Foundation, a nonprofit financial services company with a mission to “return wealth and power to the creators of value.” To learn more about Ferris, please visit the About Ferris page.Visit Ferris on:

Gini Website Coming Soon. We (

Gini Website Coming Soon. We (